How will the financial sector tick and function in ten years' time? Six writers focus on 2030 and report on the future. Virtual and augmented reality play a surprisingly small role.

The Future Finance working group of Swiss FinTech Innovations (SFTI) has carried out extensive research and analyses and draws a clear picture in the discussion paper "Future of Financial Institutions - View 2030" a clear picture of the driving forces and elements of change. This discussion paper is intended to support the exchange of ideas on the future of finance and motivate people to work together to shape the future, structure and basis of the financial industry.

SFTI considers eight key topics, divided into four areas, to be formative for the future of the financial industry:

- People (Increased Importance of Trustworthiness / Changing Behaviour)

- Immediate Environment (The Empowered Digital Customer / Ubiquity of Digital User Interface)

- Broader Environment (Explosion in Digital Assets / Explosion in Private Digital Data)

- Business Landscape (Changing Business Models / Changing Business Ecosystems)

VR only has a place in a story

In collaboration with MoneyToday.ch, the members of SFTI's Executive Board present these eight key topics in six short stories. What is exciting is that so far only in the history of Cornelia Stengelthat VR and AR have a place. This is how she writes:

More and more social interactions are taking place in virtual space (virtual reality), we chat and watch clips from influencers. Experiences in the real world are supplemented with a digital layer (augmented reality), which provides us with additional information and enables us to interact with digital objects. It goes without saying that the corresponding devices record, analyse and digitise the environment for this purpose.

Opportunities also great in the financial sector

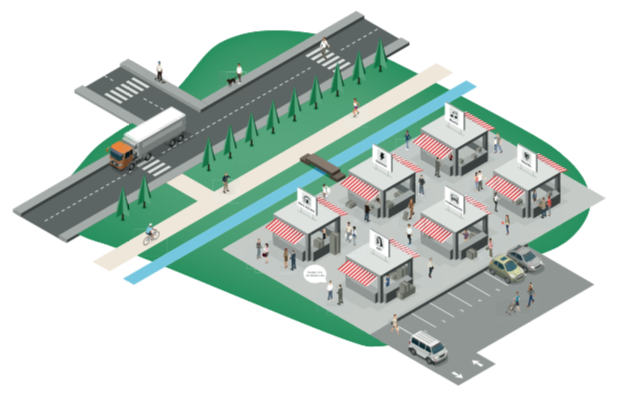

We are surprised that the other authors do not include VR in their stories as a matter of course. There are countless examples of how the financial sector can benefit from the new technology: Taking out a private pension plan with a virtual advisor in the comfort of your own home, or furnishing a potential new home in seconds while viewing it and concluding a loan agreement at the same time? This is what the future of banking with augmented reality could look like.

Source: moneytoday